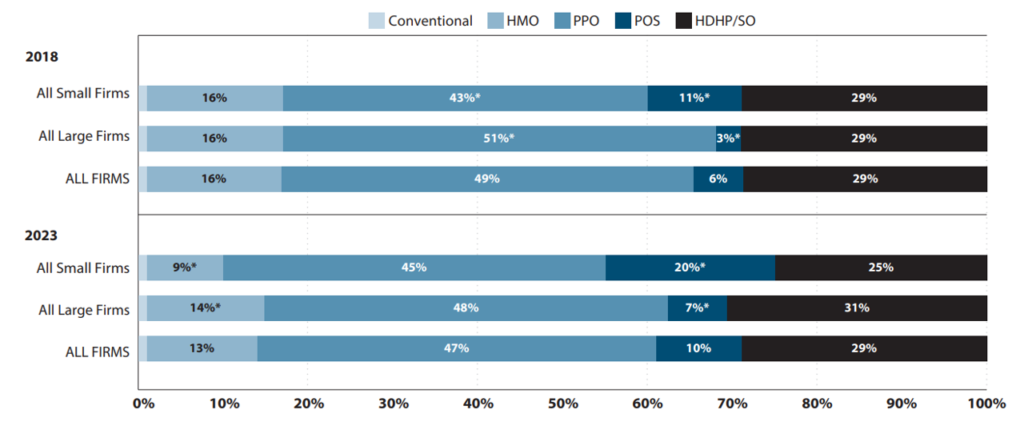

Many researchers are fascinated with how price sharing impacts well being care utilization, price and affected person outcomes. That is very true as high-deductible well being plans (HDHP) have turn out to be extra widespread within the US. In 2023, 29% of coated staff within the US had a HDHP.

One useful kind of information for analyzing HDHPs is claims information. Nonetheless, there are challenges with utilizing these information:

The primary kind [of claims data] contains detailed details about plan construction however usually has poor externality validity as it’s usually sourced from a single well being insurer or small subset of enrollees. The second kind has improved exterior validity by pooling throughout insurers however doesn’t often embody plan-structure variables essential to tell apart between HDHPs and plans with decrease deductibles, or interpret what binary “HDHP” variables characterize.

A paper by Cliff et al. (2024) goals to look at how nicely one can predict plan deductibles utilizing claims information utilizing Optum Labs information. The Optum information do have data on plan deductibles which are used because the “gold commonplace”. 4 totally different imputation approaches are used:

- Parametric prediction with spending (regress on spending methodology). Enrollee’s annual deductible spending is regressed on their whole annual spending (plan plus out-of-pocket), widespread demographic covariates (gender and age), and stuck results for every plan Use regression to foretell deductibles conditional for set spending stage with plan mounted results. Utilizing the coefficients from the best-fit regression mannequin, deductibles are predicted for every plan at a set quantity of whole spending, (which the authors set at $10,000 to exceed most deductibles).

- Parametric prediction with imputation and plan traits (Regress on imputed deductibles methodology). This strategy makes use of two levels. First, deductibles are inputed for a subset of plans the place they’re simply recognized. For the second stage, a set of covariates is created describing noticed deductible spending and plan traits and collapse information from the person to the plan stage. Utilizing the subset of plans with an imputed deductible, the imputed deductible quantities are regressed on the set of covariates; generated coefficients are then used to foretell deductibles for plans unable to be imputed within the first stage.

- Modal deductible spending (mode methodology). This straightforward methodology inputes the very best (non-zero) modal deductible spending quantity amongst enrollees in a plan and applies this deductible to all enrollees in that plan.

- eightieth percentile of deductible spending (eightieth percentile methodology). Following Rabideau (2021), particular person spending is tracked month-over-month, and people the place spending will increase in a given month however deductible spending doesn’t change are assumed to have reached their deductible. Then, the person stage information is collapsed to the plan stage and the deductible for all enrollees within the plan is ready to the eightieth percentile of annual deductible spending within the plan.

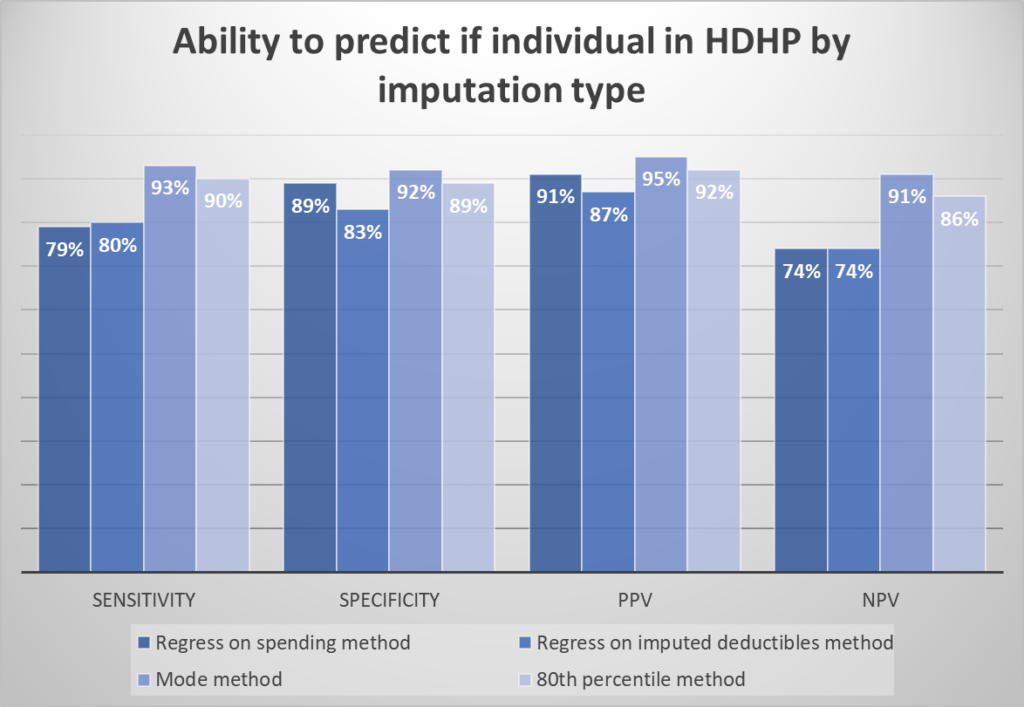

To guage the accuracy of the imputation approaches, the authors calculate the sensitivity, specificity, and constructive/unfavorable predictive worth (PPV/NPV) of every methodology for classifying enrollees into HDHP vs. non-HDHP plans.

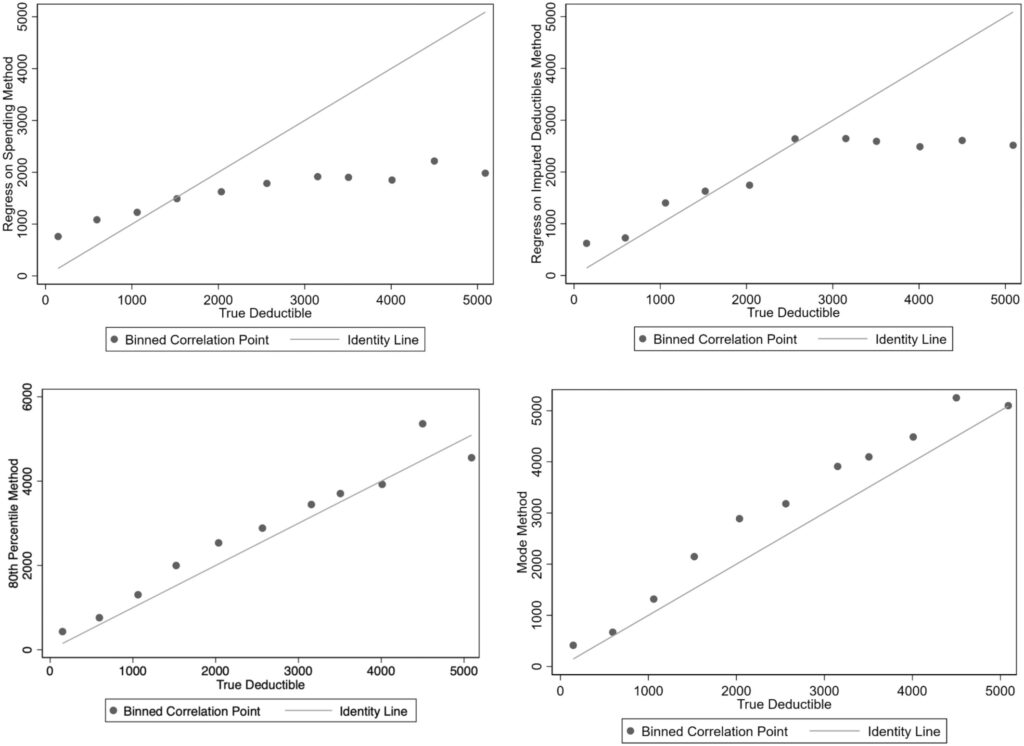

Surprisingly, the easy “mode methodology” carried out greatest by way of classifying people into HDHP vs. not. It additionally carried out nicely by way of predicting deductible spending.

The mode methodology performs greatest; 72% of plans are appropriately categorized into every class and 69% of plans have an imputed deductible inside $250 of the particular deductible. For this methodology, limiting imputation to teams with greater than 50 enrollees improved sensitivity to 85% of plans appropriately categorized by class and lowered the common distinction between the imputed and precise deductible from $700 to $496

You possibly can learn the total paper right here.